After two cuts, the Fed is back to paused

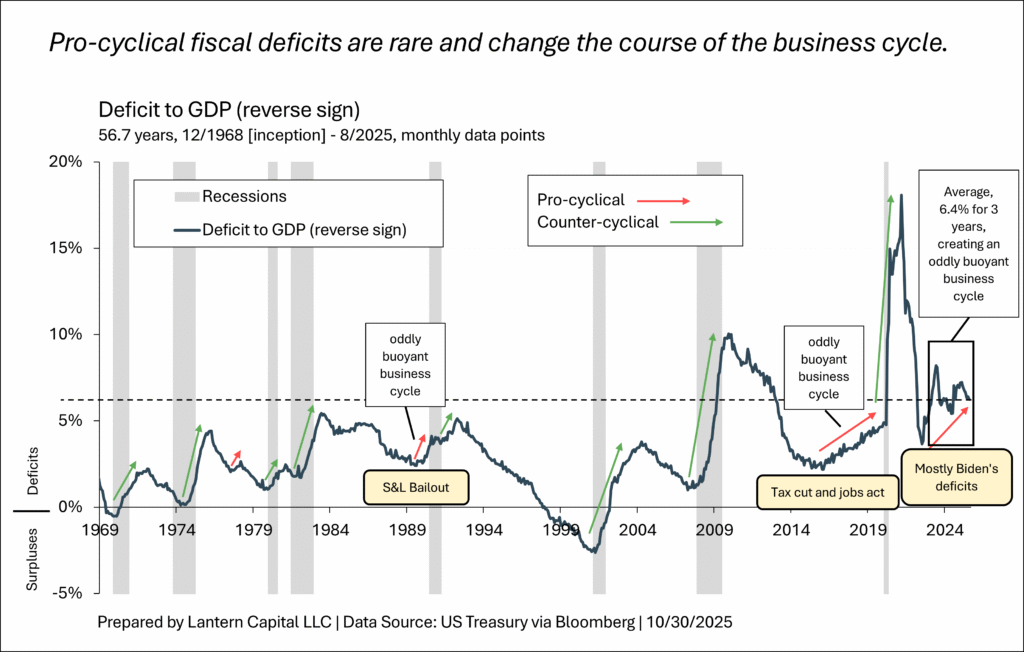

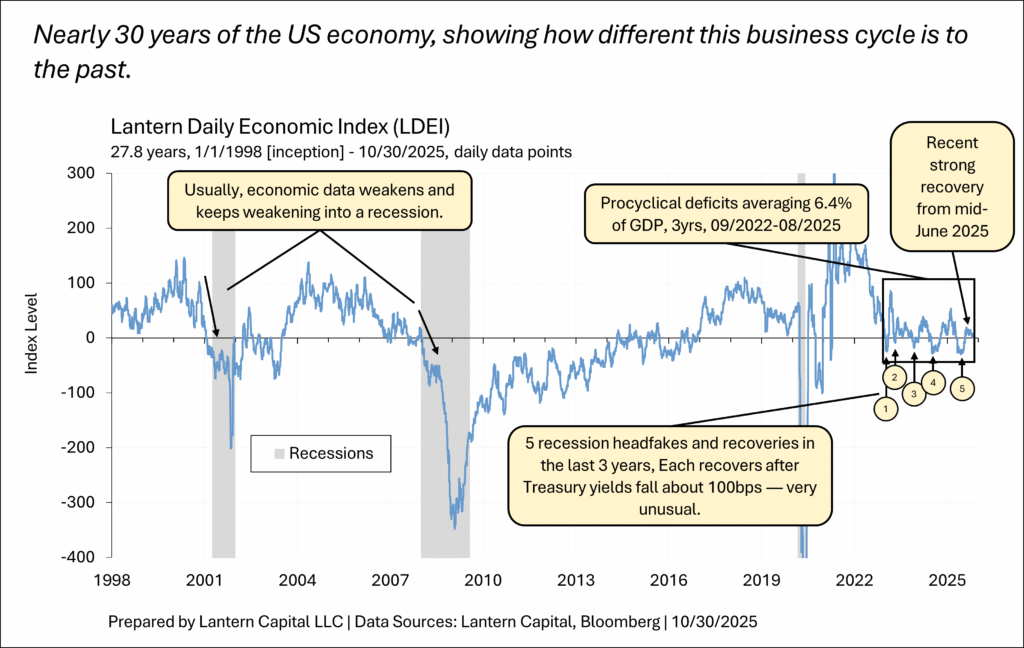

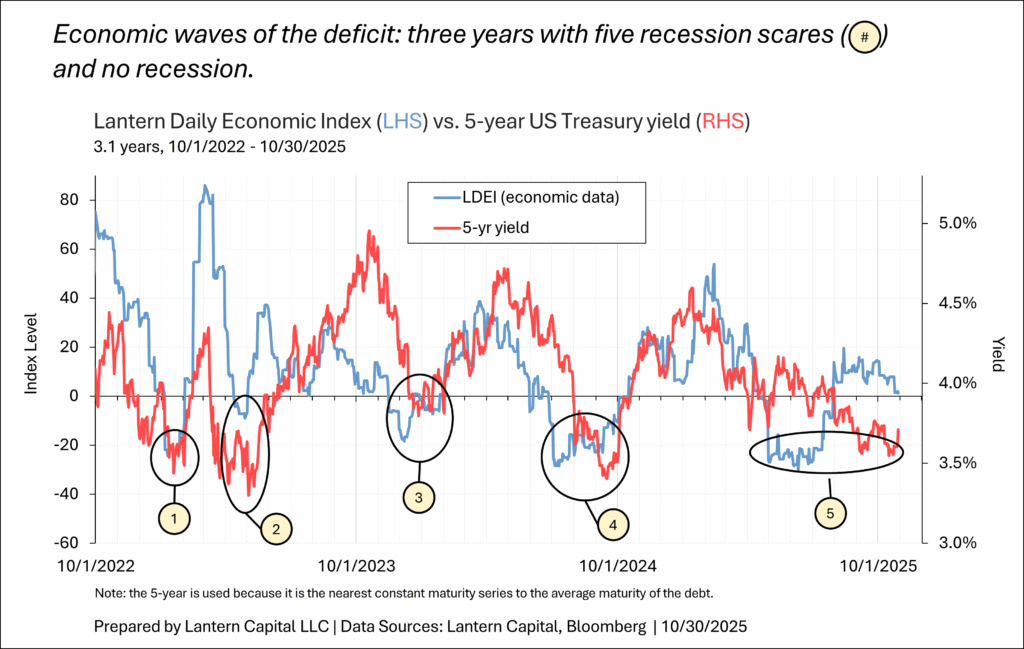

Yesterday’s FOMC meeting was a meaningful pivot that I suspect will result in significantly higher Treasury yields (particularly at the front-end/belly of the curve) over time to price-out the cutting that has been priced in, not unlike the end of last year. For a fifth time in this cycle, the bond market priced in the beginnings of a recession, but because the economy is so buoyant, likely from the large fiscal deficit (three charts below), it rebounded since data released in mid-June which eventually led to this pivot (after a detour through a labor market scare).

Jerome Powell said several things which sounded a lot like what I’ve been writing and saying to my clients and writing on X. Ten quotes follow:

1. Powell made a special mention in his prepared remarks that the Fed wasn’t certain about cutting rates in December,

In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it. Policy is not on a pre-set course.

2. But, towards the end of the press conference, Powell slipped up amid answering a question about if dissenting votes make it harder to do his job suggesting that not only does he already perceive the December meeting as a pause (i.e., not just uncertainty), he doesn’t know if/when they will start cutting again. This is a hint of him seeing the pattern of economic waves in this cycle I’ve identified, suggesting it will be a while before cutting is on the table again. Turning the whole committee around to this point took a while and it will presumably take a while to reverse course again. The only ardent doves on the committee that I see are Stephen Miran and Michelle Bowman; both with presumed political motivations. It will be interesting to see if any others make themselves known in upcoming Fed speak. I include more of the quote for surrounding context, but the bolding is the important part.

And, you know, as we have worked our way through this process, you would expect that there would be a range of views across the committee on what to do and the speed with which we should do it. And that’s what we have. That makes a lot of sense to me. These are, all of these people are, you know, people who take their jobs very seriously, work very hard at this, and just want to do what’s right for the American people, but they have different views on what that is. And, you know, it’s an honor to work among people who care that much. It is, but I, you know, I don’t feel that it’s unfair or anything like that. It just…it’s a time when we’re making quite difficult judgments in real time. And I believe we’ll get through this and I think we’ve done sort of the right thing so far this year. I think we were…it was appropriate for us to be careful about this. I think it would not be appropriate to just ignore or assume away the inflation issue. At the same time, I think the risk of higher, more persistent inflation has declined significantly since April. And, if we if we do wind up resuming rate cuts at some point….we will at some point, you know, I think we’re trying to get to the end of this cycle with the labor market in a good place and with inflation, you know, on its way to 2% or at 2%. So, that’s all we’re trying to do and we’re doing it under, you know, quite challenging circumstances and doing the best we can.

3. He suggested that labor market weakness is mainly about supply not demand,

A good part of the [labor] slowing likely reflects a decline in the growth of the labor force, due to lower immigration and labor force participation, though labor demand has clearly softened as well.

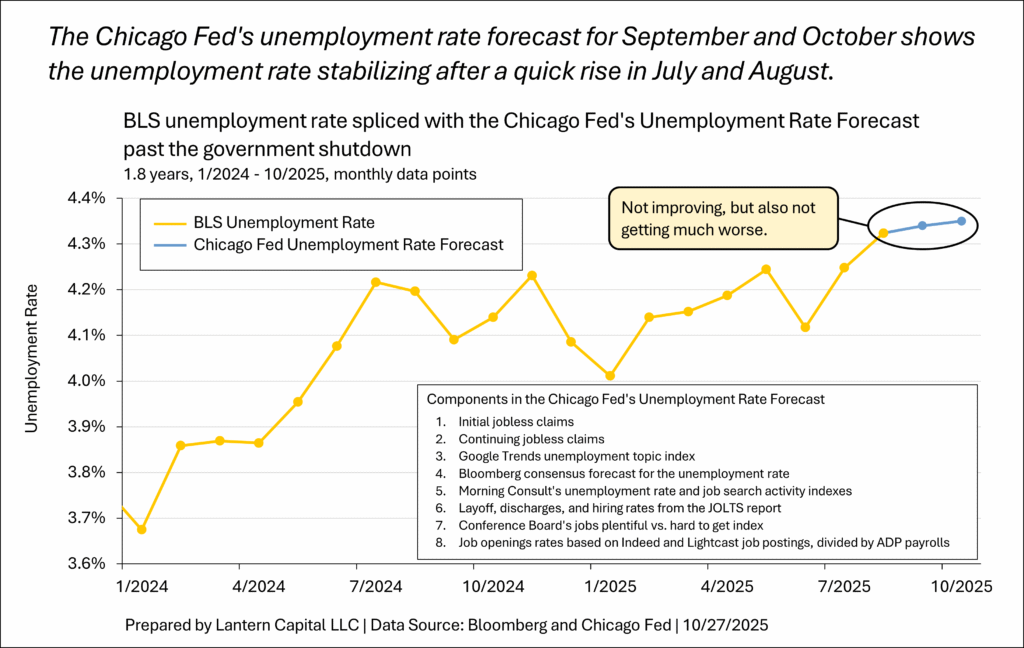

4. He suggested the labor market is stabilizing,

The fact that we are not seeing an uptick in [jobless] claims or a downtick, really, in [job] openings, suggests that you are seeing maybe continued very gradual cooling, but nothing more than that.

The chart crystallizing that idea:

5. He said that economic growth is not just AI, consumer is spending is a much bigger effect,

The investment we’re getting in equipment and all those things that go into creating data centers and feeding the AI; it’s clearly one of the big sources of growth in the economy. Consumer spending also though has been, you know, is much bigger than that and has been growing and has defied a lot of negative forecasts; continuing to do so this year. Consumers are still spending. Now it may be mostly higher end consumers, or may be skewed that way, but the consumer is spending and that’s a big chunk of what’s going on in the economy; bigger than, substantially bigger than AI.

6. He didn’t think the wealth effect from the stock market was the driver of spending,

So, there is some there’s some relationship [between the stock market and consumer spending] there, but remember uh the more wealth someone has, the lower an additional dollar of wealth matters. So your marginal propensity to consume declines quite dramatically as you reach as you reach levels of stock market wealth. So, you know, the stock market, it would affect spending if the stock market went down, but it wouldn’t drop it wouldn’t drop sharply unless there were quite a sharp drop in the, you know, in the stock market. People at the lower end of income and wealth have a much higher marginal propensity to consume of an incremental dollar of income or wealth, but they don’t have the stock market wealth. So, I think it’s certainly a factor supporting consumption right now. But, and you would see it if you saw a material correction in in u in spending, but it wouldn’t be…you shouldn’t think that that it’ll, you know, dollar for dollar stop consumption because that wouldn’t be the case.

7. He said the Fed is getting enough data in the government shutdown to know how the economy is doing,

I mentioned what we get in the labor area. We get some data in the in inflation, some data in economic activity and we’ll get…we’ll have a picture of what’s going on. We also will have the Beige Book again. I would say we’re not going to be able to have the, you know, the detailed feel of things, but I think if there were a significant or material change in the economy one way or another, I think we’d pick that up through this.

8. He said credit problems aren’t widespread,

You’ve seen rising defaults in subprime credit for some time now and now you’ve seen a number of automobile credit institutions having significant losses and some of those losses are now showing up on the books of banks. You know, we are looking at it carefully, we are paying close attention. I don’t see at this point a broader credit issue. It doesn’t seem to be something that has very broad application across financial institutions, but we are going to be monitoring this quite carefully and making sure that that is the case.

9. He said the economy is good,

You don’t see anything that says that the job market is or really any part of the economy is making a significant deterioration. Don’t see that.

and

…banks are well capitalized while some households are clearly under stress, in the aggregate, you know, households are in good shape financially; relatively manageable uh levels of debt. At the lower income spectrum, you are seeing rising defaults particularly around subprime auto but nonetheless, in the aggregate, pretty good and you don’t see too much leverage in the banking system or the financial system. It’s a mixed picture, but it’s not an over overly troubling picture.

10. He said that layoff announcements, while they are watching them carefully, aren’t showing in the data,

To start with the layoffs, you’re right, you see a significant number of companies either announcing that they are not going to be doing much hiring or actually doing layoffs and much of the time they’re talking about AI and what it can do. So, we’re watching that very carefully and you know, yes, it could absolutely have implications for job creation. We don’t really see it in the initial claims data yet. Now, it’s not a surprise that we don’t. It takes some time for it to get in there, but we’re watching that really carefully. But again, don’t see it yet in the in the initial claims data.

I will mention three things about layoff announcements because several bearish analysts think Powell was tone deaf yesterday based on this topic:

a. Tech layoffs are looking to be the lowest of the last four years (https://layoffs.fyi/)

b. It is impossible to know from layoff announcements who gets rehired elsewhere, the effect really needs to be seen in jobless claims first.

c. Continuing (and initial) jobless claims are so low historically, they need to rise about 630k before reaching a level where any past recessions have begun (as a percent of the labor force). Recent layoff announcements are around 200k.

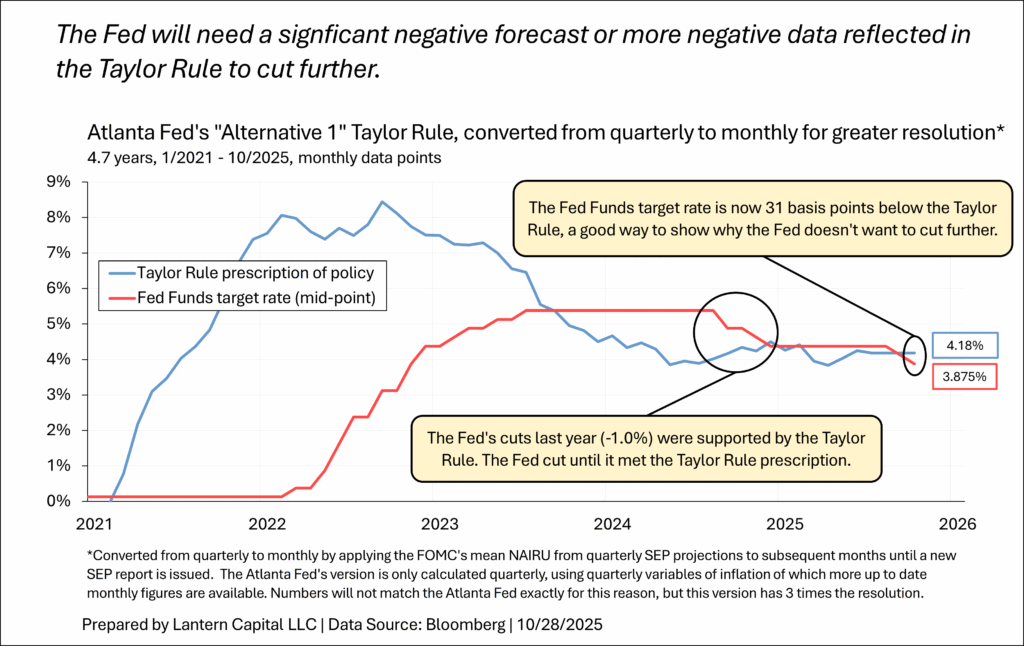

Also, notice that the Fed paused right after they crossed the line into the most popular formulation of the Taylor Rule. The Taylor Rule is important to monitor.

There will be another wave of economic deterioration ahead (likely into recession this time based on credit problems starting to crop up now and how low payrolls are; their long-term trend matters) but based on the deficit suspended waves of economic recovery for the last three years, I don’t think it will be until rates rise to constrict the economy again. I see the next wave downwards happening again in February or March once this economic recovery wave has time to go through its paces.

At the same time, I am waiting to see layoffs trending higher, economic data trending lower (LDEI), and corporate markets broadly weak (corporate bond spreads, equities, loan availability) to know something has materially changed from the pattern of the last three years. Despite my expectation for that happening early next year, as soon as it happens, I will see that as a big change in the economy.