Expect the Fed to remind markets about real economic strength this week

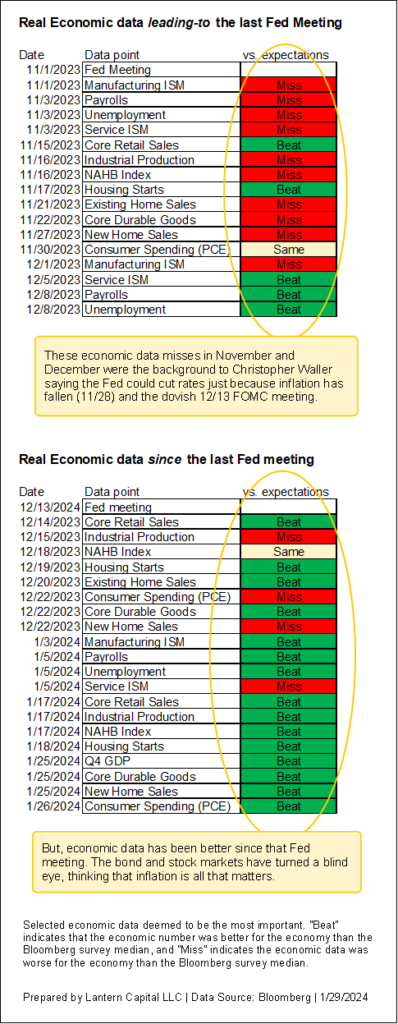

The idea that the Fed can cut rates soon just because inflation has fallen has kept the bond market expecting a rate cut as soon as March (50% chance as of today) and the stock market elevated. This theme has allowed the bond market to mostly turn a blind eye to a string of good economic data this month, thinking inflation is all that matters. But the strength of the real economy is just as important to Fed policy, it has mostly surprised to the upside since the last Fed meeting (see graphic below), and the Fed will need to acknowledge it at their meeting this Wednesday.

Based on the economic data shown above, the latest hawkish Fedspeak, and an improved Beige Book, I think the Fed is going to try to reduce the bond market’s Fed cutting expectations at their meeting this Wednesday. The economic data will soon weaken again based on the stage of the business cycle we are in, but for now, the Fed is going to want to clarify that a rate cutting cycle requires more than just lower inflation.