FOMC meeting was ultimately hawkish

The first thing to mention is that I was wrong about the Fed being paused after the last meeting, they cut another 0.25% yesterday. What I wasn’t wrong about is the trajectory of the economy and Fed as it gets progressively better and more hawkish respectively, as “labor lore” recession fears fade away. The Fed made a definitive statement of pausing, using the identical language in their statement that they used last December when they paused,

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

And while these hawkish things occurred, the combination of events (statement, summary of economic projections (SEP), press conference) were less hawkish than feared and bond yields fell for three reasons:

1. There were fewer dissents to hold rates steady than feared. There were two dissents from Jeffrey Schmid and Austan Goolsbee to hold rates, not four or five that some thought.

2. The median dot for Fed Funds at the end of 2026 and 2027 was unchanged from the last SEP.

3. Powell explained why they decided to cut today rather than wait,

First of all, gradual cooling in the labor market has continued. Unemployment is now up three tenths [of a percent] from June through September. Payroll jobs averaging 40,000 per month since April. We think there’s an overstatement in these numbers by about 60,000, so that would be -20,000 per month. Um, and also just to point one other thing, surveys of households and businesses both show decaying demand for workers. So I think you can say that the labor market has continued to cool gradually, maybe just a touch more gradually than we thought. Um, you know, in terms of inflation, we are it’s come in a touch lower. And I think the evidence is, is kind of growing that what’s happening here is services inflation coming down.

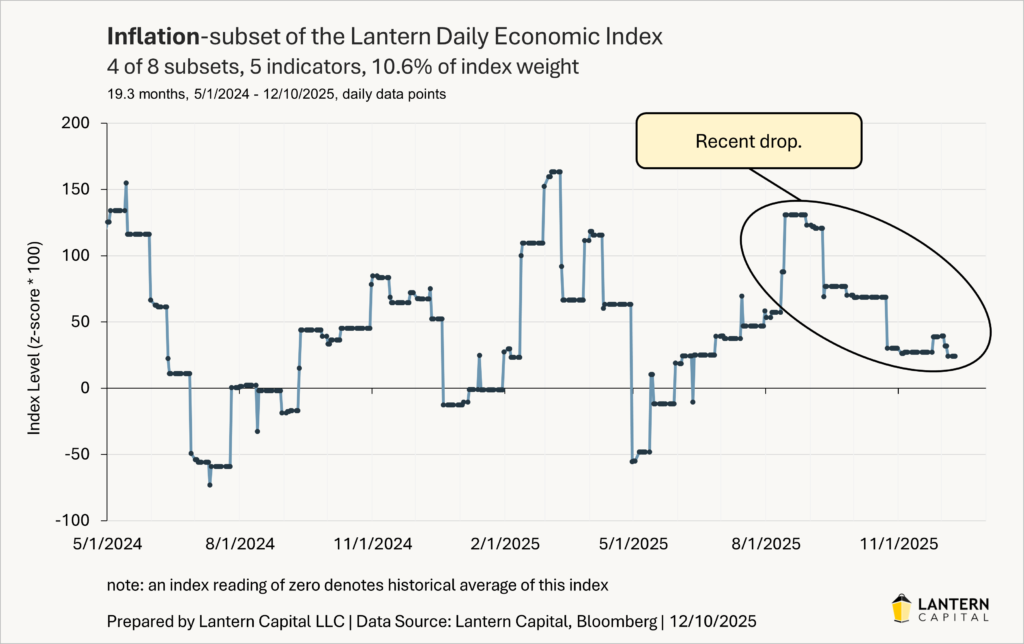

I think that Powell is too sanguine about future inflation given that 60% of the CPI (core services, presumably not from tariffs) has risen 3.9% annualized over the last three months, but the inflation component of the LDEI has fallen since late August (the main driver of why the LDEI has fallen over the last 2-3 months) and so it isn’t surprising to see Powell reflect this as well (chart below).

But, outside of those dovish elements, the meeting has longer-term bearish implications for Treasury yields for five reasons:

1. At a few instances in the press conference, Powell said that rates were now “within a broad range of estimates of neutral” which means that there isn’t a pre-conceived plan to cut back to 3% to get to “neutral” as has been the narrative. Different FOMC members will argue the neutral rate is at different levels, but this was a way for him to say, “don’t expect any more cuts until weak data suggest them”.

2. The median FOMC member expects there to be just one more cut next year, but the bond market is priced for 2.3, leaving room for higher yields as the negative forecast fades away.

3. The SEP showed that real GDP growth in 2026 is expected to be +0.5% higher now than in their previous SEP; 2.3% vs 1.8% before, which goes in the opposite direction of a recession.

4. Powell affirmed and the SEP shows that most Fed members only expect the unemployment rate to rise another tenth or two of a of a percent and then stabilize in 2026, which again, goes in the opposite direction of a recession.

5. With Austan Goolsbee dissenting to hold rates, his ideas will gain strength in the discourse that argue the labor market isn’t weak, covered well in my piece this week on Advisor Perspectives, “The 6% deficit, post-lore economy”

I continue to expect a wave of better economics and higher yields ahead, which will end once rates rise enough to constrict the economy again; the “post-lore economy.”